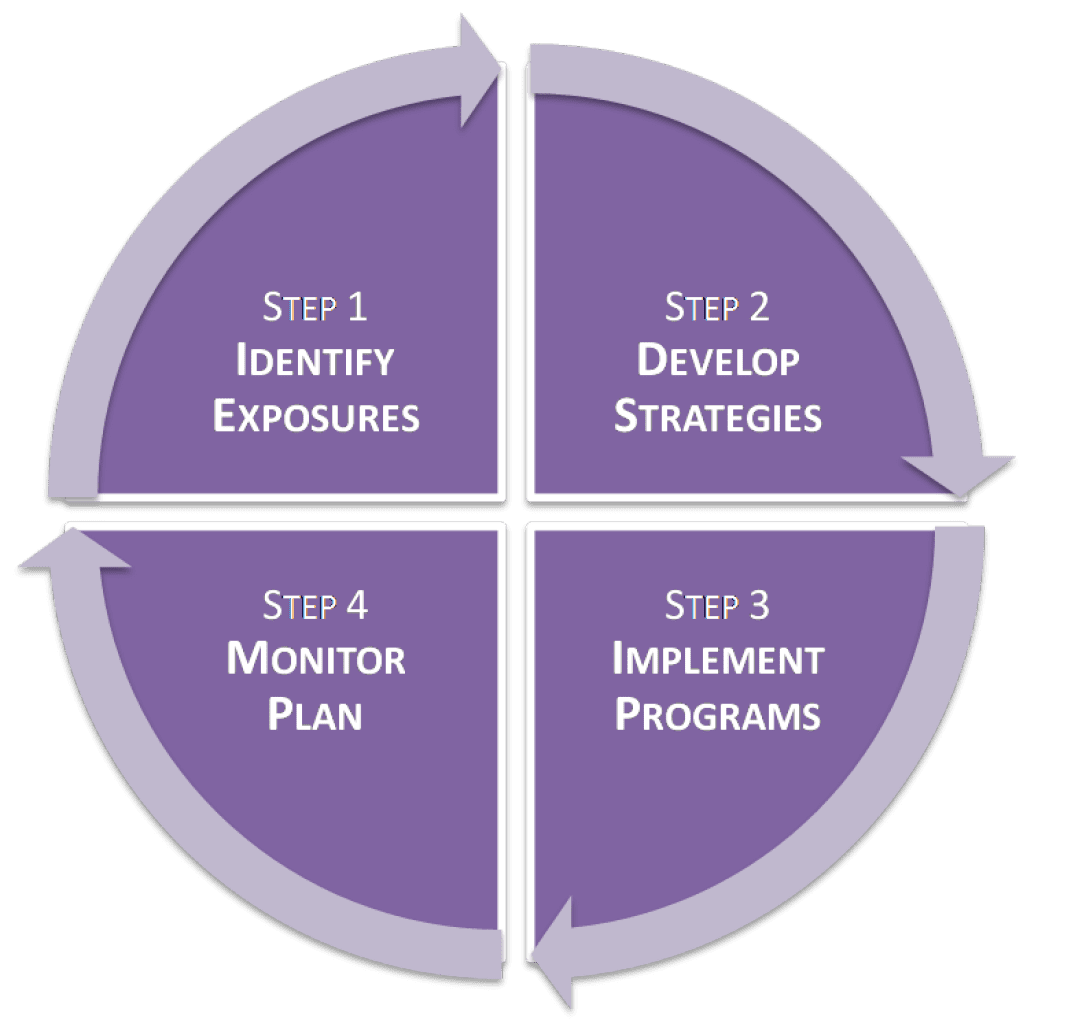

Step 1 – Identity Exposures

- During this crucial initial phase, we invest the time to understand every facet of your business in order to help you and your team identify the risks that face your business. By evaluating the effectiveness of risk management programs, practices, and resources under real-world conditions, we assure that your assets receive precisely the right type of protection.

Step 2 – Define Strategies to Handle Risk

-

Once we have developed a thorough understanding of your business, including your industry, corporate culture and operating procedures, we move beyond insurance, exploring a spectrum of proven alternative strategies to minimize risk and reduce insurance costs.

Step 3 – Implementation of Programs

-

During the implementation process, we put in place specially tailored programs and strategies designed to protect your assets while reducing insurance costs. A strong belief in our process motivates underwriters to offer much lower insurance costs on your behalf.

Step 4 – Ongoing Monitoring & Adjustment

-

You and your business are dynamic – what works for you today might not work as well tomorrow. For this reason, we continue to monitor and adjust your risk management programs to ensure a perfect fit as your business evolves and changes.

Step 1 – Identity Exposures

- During this crucial initial phase, we invest the time to understand every facet of your business in order to help you and your team identify the risks that face your business. By evaluating the effectiveness of risk management programs, practices, and resources under real-world conditions, we assure that your assets receive precisely the right type of protection.

Step 2 – Define Strategies to Handle Risk

-

Once we have developed a thorough understanding of your business, including your industry, corporate culture and operating procedures, we move beyond insurance, exploring a spectrum of proven alternative strategies to minimize risk and reduce insurance costs.

Step 3 – Implementation of Programs

-

During the implementation process, we put in place specially tailored programs and strategies designed to protect your assets while reducing insurance costs. A strong belief in our process motivates underwriters to offer much lower insurance costs on your behalf.

Step 4 – Ongoing Monitoring & Adjustment

-

You and your business are dynamic – what works for you today might not work as well tomorrow. For this reason, we continue to monitor and adjust your risk management programs to ensure a perfect fit as your business evolves and changes.